All Categories

Featured

Table of Contents

Tax obligation sale overages, the surplus funds that result when a property is cost a tax sale for even more than the owed back tax obligations, charges, and expenses of sale, represent a tantalizing opportunity for the initial homeowner or their successors to recuperate some worth from their shed asset. The process of asserting these excess can be intricate, mired in legal treatments, and differ significantly from one territory to one more.

When a home is cost a tax sale, the primary goal is to recuperate the unpaid property tax obligations. Anything above the owed quantity, including fines and the expense of the sale, becomes an overage. This overage is basically cash that must truly be returned to the previous homeowner, thinking no various other liens or claims on the residential property take precedence.

Recouping tax obligation sale overages can without a doubt be difficult, laden with lawful intricacies, administrative difficulties, and possible risks. With appropriate preparation, recognition, and often expert aid, it is feasible to navigate these waters successfully. The secret is to approach the process with a clear understanding of the demands and a calculated strategy for resolving the barriers that might occur.

Tax Houses Near Me

You might have incredible investigatory powers and a group of researchers, however without recognizing where to seek the cash, and exactly how to get it out legitimately, it's just intriguing details. Now picture for a minute that you had an evaluated, proven 'prize map' that showed you how to discover the cash and how to obtain it out of the court and into your account, without stressing over finder laws.

Previously that is . Yes! . what when was difficult is currently quickly accomplished . And what we show you will have a larger influence on your financial future than anything else you have ever seen online. Insurance claim massive blocks of cash, some $100K+!, with absolutely no competition? Were the just one that additionally go after home mortgage and HOA repossession overages! Partner with a company that will educate you and do all the hefty lifting for you? Operate a business that will allow You to call the shots and has no limitation on earnings? Have accessibility to YEARS of data, where you could literally pick & choose what to take? Assist other individuals while you are developing individual wide range? Make no mistake - this is not a 'obtain abundant quick' program.

Avoid mapping is the process of locating existing call details, such as addresses and telephone number, to situate and speak to someone. In the past, avoid mapping was done by debt collection agency and private detectives to locate individuals who where skipping out on a financial obligation, under investigation, or in difficulty with the regulation.

To acquire clear title after a tax obligation activity has in fact been acquired, please contact an attorney to start that procedure. The buyer of a mobile home will absolutely be required to license a restricted power of attorney to allow the Region to title the mobile home in your name at the SCDMV in addition to sign up the mobile home with the County.

The legislation asks for that an insurance claim be submitted. By regulation, we can not approve cases after one year from the taped day, neither can we start processing of cases up till one year has passed from the precise very same day. The Tax Collection company will send a referral to the Board of Supervisors concerning the disposition of the excess profits.

The homes cost the DLT sale are marketed to collect overdue tax obligation commitments owed to Jackson Area, MO. If the residential property prices higher than what is owed in tax obligation commitments and fees to the Region then present record owners(s) or other interested occasions, such as, a lien owner might request those funds.

Tax Property For Sale

Please note: This details is for academic features simply and is illegal recommendations or an alternative to collaborating with legal recommend to represent you. No attorney-client connection or benefit has in fact been developed as an outcome of this conversation and no privacy fastens to anything said here on a public internet site.

The California Profits and Tax Obligations Code, Section 4675, states, in element (reworded): Celebrations of Interest rate and their order of concern are: First, lien owners of record prior to the recordation of the tax obligation action to the customer in the order of their leading concern (Unclaimed Tax Sale Overages). Any kind of sort of private with title of record to all or any kind of section of the home before the recordation of the tax obligation deed to the buyer.

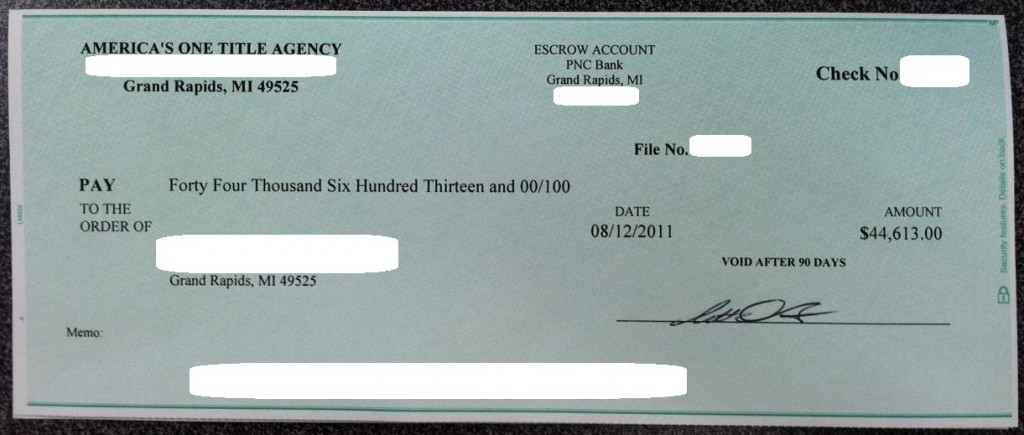

Tax Obligation Sale Overages Tax Auction Overages Before the option by the Court, Michigan was amongst a minority of states who permitted the retention of surplus revenues from tax-foreclosure sales. back tax property auctions. Residential or business home owners that have really shed their home as an outcome of a tax repossession sale presently have a claim versus the location for the distinction between the amount of tax obligation obligations owed and the amount recognized at the tax commitment sale by the Region

In the past, miss out on mapping was done by financial debt enthusiast and private investigators to find people that where staying clear of a debt, under examination, or in problem with the regulation.

That is needed to submit tax obligation excess hands-on pdf? All individuals that are required to file a federal income tax obligation return are also required to file a tax obligation overages handbook.

Paying Back Taxes On A Foreclosure

Depending on their declaring standing and income degree, some individuals may be called for to submit a state income tax obligation return. Exactly how to load out tax excess hands-on pdf?

Following the instructions on the kind, submit all the fields that are appropriate to your tax circumstance. Ensure to provide exact information and check it for precision. 3. When you pertain to the section on declare tax overages, see to it to offer all the information needed.

Send the form to the relevant tax authority. What is tax obligation excess manual pdf? A tax overages hands-on PDF is a file or overview that gives info and guidelines on exactly how to locate, accumulate, and case tax excess.

Tax Sale Property Listings

The excess amount is typically reimbursed to the proprietor, and the guidebook gives support on the procedure and procedures associated with claiming these reimbursements. What is the objective of tax excess hands-on pdf? The objective of a tax excess manual PDF is to offer info and advice associated to tax excess.

Tax Year: The details year for which the overage is being reported. Quantity of Overpayment: The complete quantity of overpayment or excess tax obligation paid by the taxpayer. Resource of Overpayment: The factor or source of the overpayment, such as excess tax obligation withholding, approximated tax settlements, or any type of various other appropriate source.

Reimbursement Demand: If the taxpayer is requesting a refund of the overpayment, they require to show the quantity to be reimbursed and the recommended technique of reimbursement (e.g., straight deposit, paper check). 6. Supporting Papers: Any kind of relevant sustaining papers, such as W-2 types, 1099 types, or various other tax-related invoices, that validate the overpayment and validate the refund demand.

Trademark and Day: The taxpayer should sign and date the document to license the precision of the information supplied. It is very important to keep in mind that this details is common and might not cover all the specific requirements or variants in different areas. Always get in touch with the appropriate tax obligation authorities or seek advice from a tax specialist for exact and up-to-date information relating to tax overages reporting.

Latest Posts

Invest In Tax Liens Online

Buying Properties For Delinquent Taxes

List Of Homes Owing Back Taxes